Paulo Pinto

Alti Wine Exchange founding member

Dear reader,

Every 24th day of the month I sit down figuring out what I spent. It’s an exercise that I do every month

because I want to see how much I spend to live.

There are two reasons for me to do that. One is my own way of checking inflation, and the other is that it

allows me to be aware of how much I will need per month when I retire.

The first three months of the year have seen a huge increase in gasoline and in vegetables. I can tell you

that from my accounts.

When you think about retirement, you must think about your pension and the return you can make of

it.

***

On that front, we got bad news. This headline from Yahoo Finance: “ECB wants to keep yields in check

while economy heals, Lane tells FT”

And the article goes on to say:

“The European Central Bank is aiming to stop bond yields from rising before the pandemic-hit euro zone

economy is ready to digest higher borrowing costs, the ECB’s chief economist Philip Lane said in an interview

published on Tuesday. ‘Our objective is basically to make sure the yield curves, which play an important role in

determining overall financing conditions, do not move ahead of the economy’, Lane told the Financial Times.”

That statement is just an obscure destructive theory, making it too

difficult for most people to sort out cause and effect – but it basically means the ECB will control

interest

rates across all government bond maturities, printing money to buy bonds while governments are

overspending and overborrowing.

The reason this is an obscure destructive theory is because people, politicians included, have come to

think

that a central bank is a magical entity that can do almost anything to make things better. Mortgages are almost free

but deposits at the bank make no money – favoring debtors and punishing savers.

But guess what? Mainstream news media keeps saying inflation has not topped 2% since 2010 and is not

worried

at all about inflation.

***

One way to participate in discussions is to have something to say and have a point of view, but people

today

seem not to know how to ask questions and when they do, seem satisfied with superficial answers.

It’s

no coincidence that most social media that have taken over our phones makes us read only a little, write a little

and

also probably think just a little too.

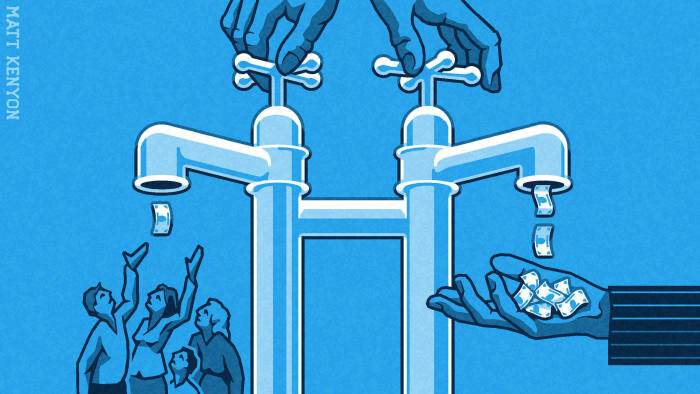

It is critical that we understand our monetary system and our money as much as possible. It is critical we

understand what it means governments running massive deficits and issuing huge quantities of debt.

It is critical to understand that, when central banks print money to buy bonds that the free market will

not

buy – with the intention to lower rates –, it raises inflation pressures.

After all, this trend we are seeing is not new, and has happened many times in history. It always

ends with inflation and a debt crisis.

If you value your money, you will take action and be prepared – because the real value of money is

its purchasing power. And that also means truly understanding the need to be careful with stock frenzies,

and low-return bonds.

***

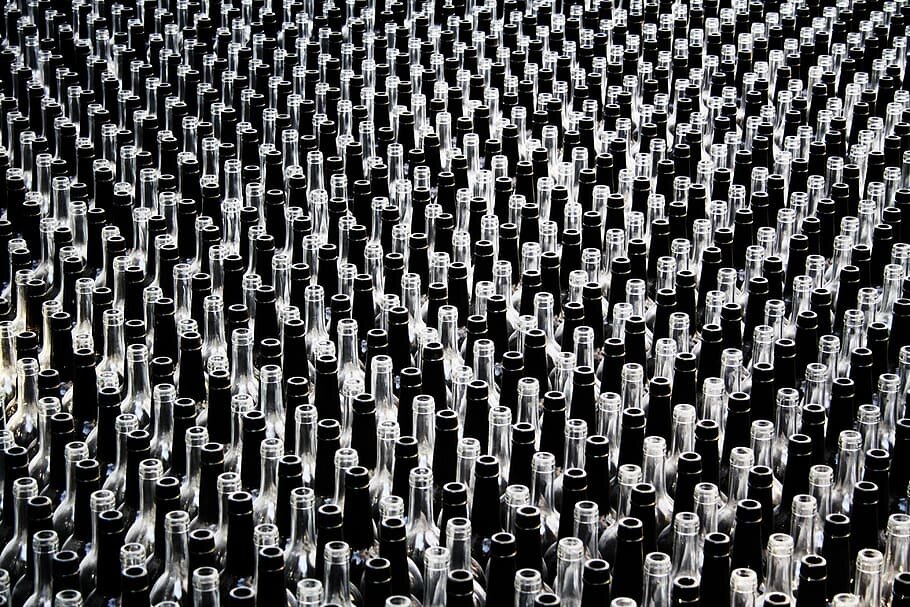

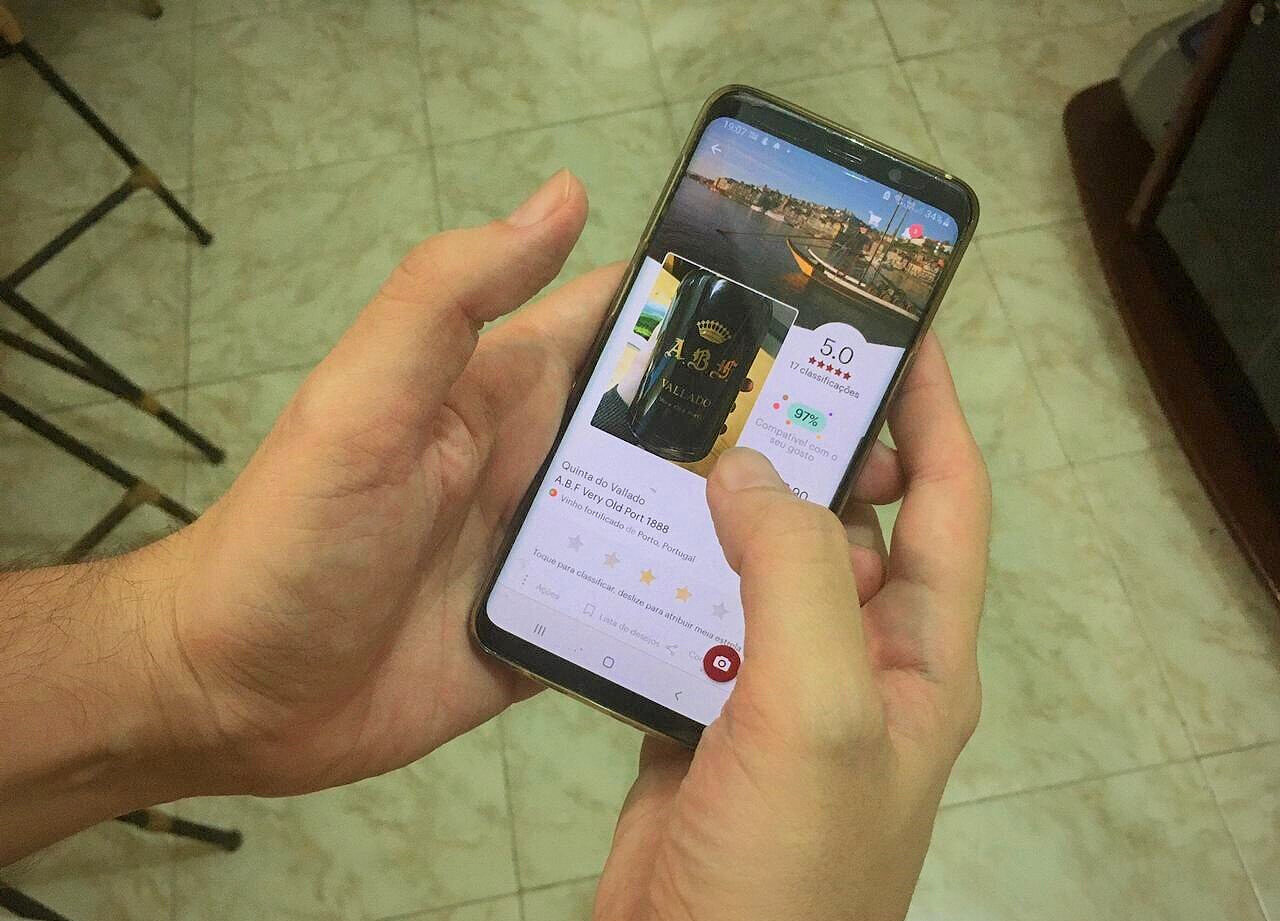

We at Alti Wine Exchange don’t just go along with what the talking heads in the media are saying. The

actions we are seeing can only lead to buying opportunities if you know where to look.

That is part of our raison d’être – providing true alternatives backed by hard

assets to investors and consumers.

Fine wine is not yet mainstream and that is a good thing, because man is a luxury-loving animal – and fine

wine is a luxury product. And, unlike many other assets, fine wine is not in a financial bubble.

This means a whole new niche on its own and the opportunity to build wealth in a new way,

making it easier for anyone to start a new form of investment.

Also, creating digital tokens to represent tangible assets allows those newly listed assets to be bought

and

sold efficiently, swiftly and with full transparency.

* * *

We have been writing about this theme for a year, suggesting the need for a new monetary system.

Think forward, think for yourself. But make sure to stay aware.

And, in the meantime, don’t keep all your eggs in one basket, avoid debt and stay

diversified.

More articles by Paulo Pinto

Building a sound strategy for your resources in the face of inflation and worsening living standards has

become more crucial than ever

Away from falsely reassuring economic news, seeking alternative financial strategies is inevitable in

the

face of low interest rates and looming inflation

It takes personal trust to let the next generation run its own course in a world where everything and

everyone are being homogenized