Photo: Martyna Jovaišaitė Paukštė, for Alti Wine Exchange

Dear reader,

When we think of alternative investments and hard assets, many possibilities are available when it comes to passion. Jewellery, art, rare watches, handbags, stamps, classic cars, even furniture?

As wealth consultants update their indexes with ever-changing investments that constantly grow in investor’s esteem, some of these high-end collectible items are a true gem when it comes to boosting and diversifying our portfolio. Our favourite, as you know, are fine and rare wines!

Why fine wine is a passion asset

Just as Deloitte defines the abovementioned investment products as passion assets, fine and rare wines have the advantage of being highly collectible and consumed, having their supply lessened as time goes by, becoming rarer and appreciated via logics of supply and demand.

In 2018, real estate consultant Knight Frank reported that 68% of respondents in its Wealth Report indicated their high-net-worth clients had become more interested in wine as an area of investment. An year later, fine wine, within their Luxury Investment Index, went up by 1%, ammassing 120% in a 10-year total.

The fine wine market resembles the art market in many ways. Among them, to be a wine investor, one doesn’t have to be a big connoisseur of wine, if they re well advised – even though having some good knowledge is much appreciated.

True oenophiles have a very good understanding of the value of each wine, vintage and characteristics. Above all: they give an enormous importance to patience in developing their cellars and collections, buying the right wines (with or without trusted advisors) and securing careful conditions for storage, at great expense.

Some high-rolling wine lovers also understand fine wine as a passion as well as a valuable commodity. A few of them we can easily identify include composer Andrew Lloyd-Webber, billionaire Bill Koch, restaurateurs Gene Mulvihill and Leslie Rudd and former superstar football manager Alex Ferguson.

A few tips on fine wine investment by us:

-

Condition. Knowing it is in perfect storing conditions, you can be sure your asset is not only intact and un-damaged, but ever attractive for potential buyers when you plan on selling in the future. The wines offered on Alti Wine Exchange are held in bond unless you want to redeem them, ensuring the best conditions of storage.

-

Age-worthiness. The Alti Wine Exchange-listed fine wines, unlike the vast majority of wines, maintain quality over the years or even enhance their finest characteristics, becoming truly prized assets (more information here).

-

Number of bottles available. Assuming demand is the same time for your wine, the supply will be ever shorter, as the amount of bottles of a determined wine lessens because they will have been consumed over time. Meaning, a much higher value for one of its bottles in the future.

What makes fine wine a great profitable option among passion assets

As we have recently mentioned, in times of economic uncertainty, many investors go for physical and tangible assets: some buy real estate, gold, or art. These are famously referred scarce resources when we talk real, hard assets.

Fine, rare wines like the ones offered by Alti Wine Exchange and traded on its marketplace have unique advantages:

-

Without even having to get off the couch, you can digitally invest in them to be kept with full safety and perfect storing conditions in bond.

-

Unlike cryptocurrencies, for example, fine wines you purchase at Alti Wine Exchange are asset-backed (one token, one bottle).

-

You can physically enjoy your investment (you can ask for delivery at any time you want).

-

Wine has perpetual demand (as a consumer product), and every fine wine sold at Alti Wine Exchange improves with age.

-

Fine wine investment is based on supply and demand: as time goes by, bottles of a determined vintage are consumed, thus supply becomes rarer and makes the remaining ones appreciate due to stable or rising demand.

-

Even if wine price indexes may experience ups and downs, fine wines are hard assets that are not correlated to the stock market, thus subject to constant appreciation once you already hold them.

-

You can put bids and offers whenever you want in a secondary marketplace, maintaining full control.

-

You also have tax advantages, because considered a waste asset (but always check with your tax advisor in case you redeem a bottle!)

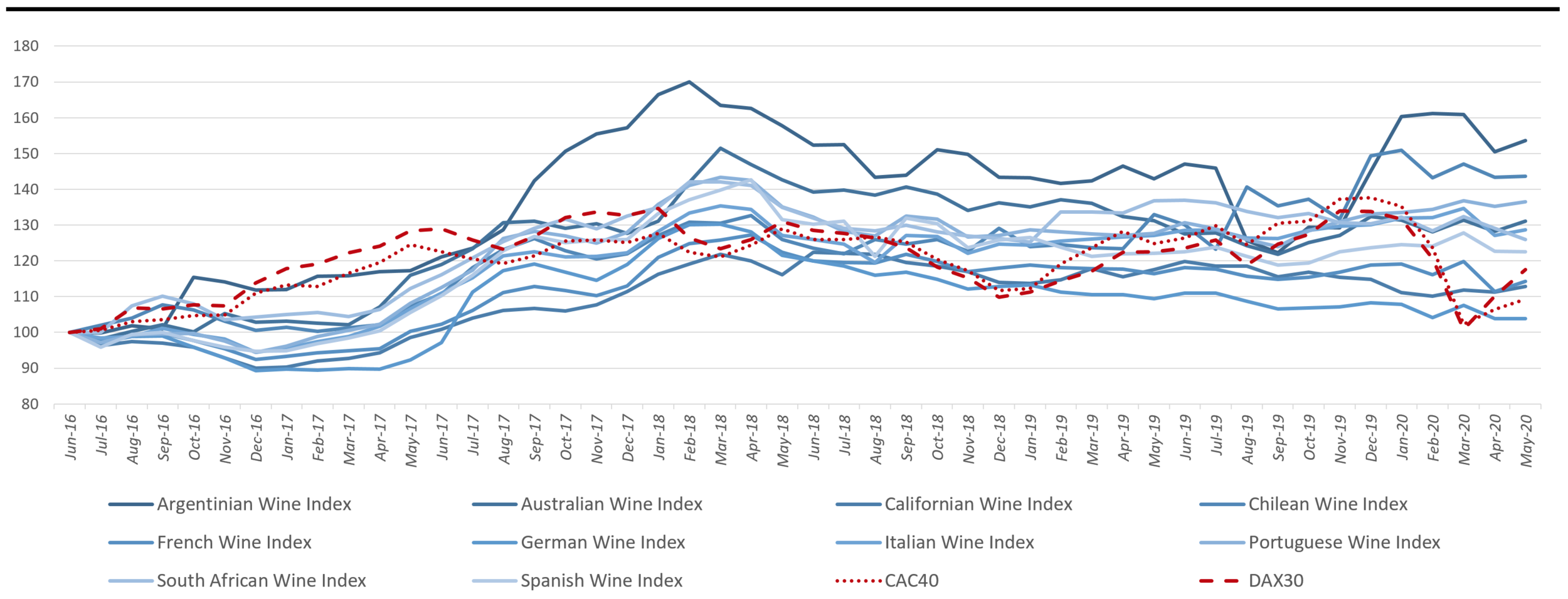

Don’t believe how this translates into appreciation? Compare the performance of our fine wine indexes versus key European stock indexes.

A new strategy to build wealth with the help of fine wines

As we go through this era of risks, it’s time to consider the strategic opportunity that a tangible asset such as fine and rare wine represents. Here’s how you can adopt a simple strategy:

-

Commit around 3 to 5% of your portfolio to alternative assets as fine and rare wine.

-

Research the wines you would want to hold, ensuring they will withstand the test of time or improve as the years go by (the wines offered at Alti Wine Exchange are all previously proven to be age-worthy).

-

Find a reliable source, with certified provenance, to build your “wine collection” portfolio to avoid cold calls and scams.

-

Unless you plan on redeeming your bottles, keep them in bond for years to ensure the best storing conditions. Consequently, ensuring the maximum possible appreciation they can have as tangible assets.

-

When you are all set and good to go, you can start to invest even monthly, as you would do with the spare of your salary.

-

Buy diversified wines (country, vintage, style…).

Here are a few top tips on what you really need to know to start investing in fine wine.

With our innovative blockchain-based platform, you can do it all I showed you above with little concerns, full transparency and safety.

We are the world’s first blockchain-based platform for wine exchange. We work every day to make wine trading simple and convenient for everyone by offering direct access to rare wines and — at the same time taking care of storage and security of their assets in the Bordeaux City Bond.

We are happy to say that we have a whole team of superstar investment-grade wines available for investment now.

In times when stocks may heavily drop or float, what we offer is an opportunity to add fine, rare vintages to your portfolio as great alternative assets. You don’t even have to be an expert.

Most importantly? We are free to join and easy to start trading. Got doubts? Check our FAQ.