Bordeaux fine wines are known around the world for their quality, but are great investment assets too. (Frame by Julien Miquel)

(Sergey Glekov

Senior financial advisor)

Having a long and illustrious winemaking history, Bordeaux does not need a long introduction.

Bordeaux is one of the most famous, prestigious and prolific wine regions in the world. It is no surprise that Bordeaux is currently home to the largest proportion of investment-grade wines.

Fine wine prices are typically not very volatile. However, they still can be affected by a number of factors.

The purpose of this article is to examine a long-term price evolution of several most prolific fine wines from Bordeaux.

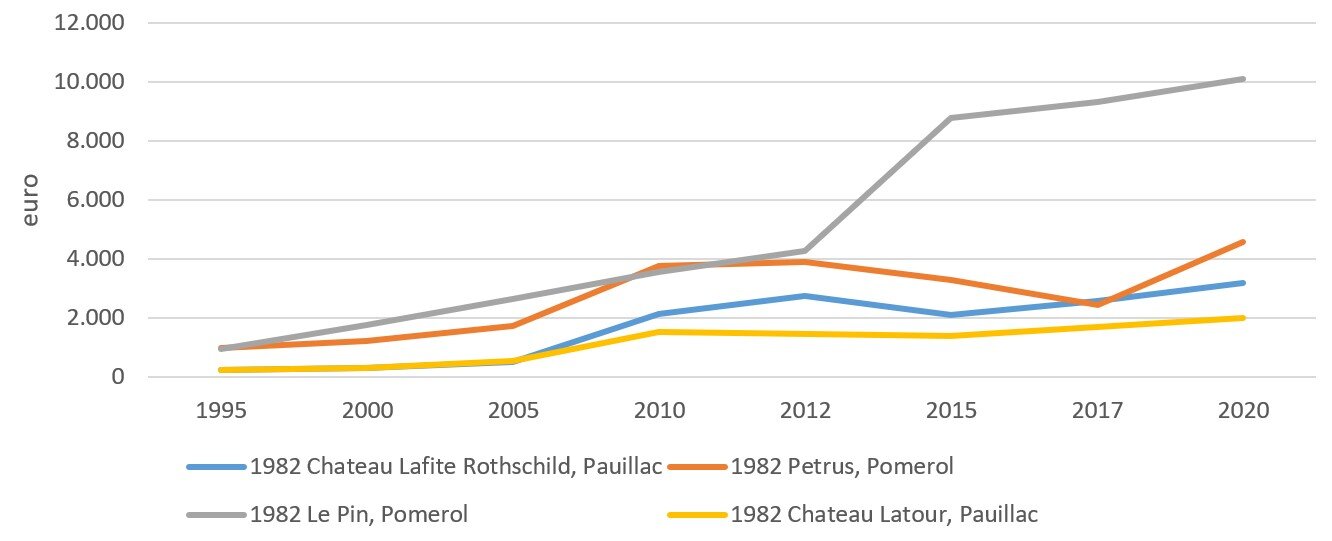

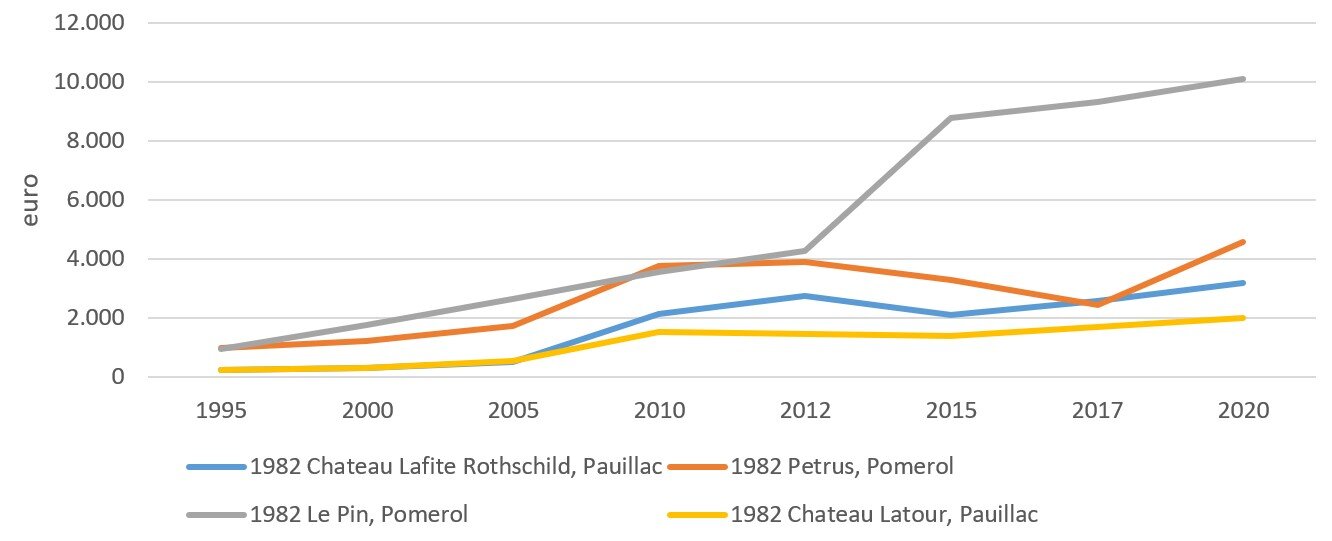

The first peer group includes four Bordeaux wines of 1982:

-

1982 Chateau Lafite Rothschild, Pauillac

-

1982 Petrus, Pomerol

-

1982 Le Pin, Pomerol

-

1982 Chateau Latour, Pauillac

1982 was an outstanding wine vintage that produced some of the most complex profound Bordeaux wines.

Price statistics for the top end Bordeaux vintages are available since 1995. The data for 1995-2017 comes from the FINE Auction Index, a composite of average prices for wines sold at commercial auctions in 20 countries. The 2020 prices are retail prices collected from wine-searcher.com.

Exhibit #1

Price of Bordeaux wines peer group, vintage of 1982

Exhibit #2

Price dynamics of Bordeaux wines peer group, vintage of 1982

A price of 1982 Petrus, Pomerol has increased in almost 5 times since 1995. 1982 Chateau Lafite Rothschild, Pauillac saw its price in almost 13 times higher than 25 years ago.

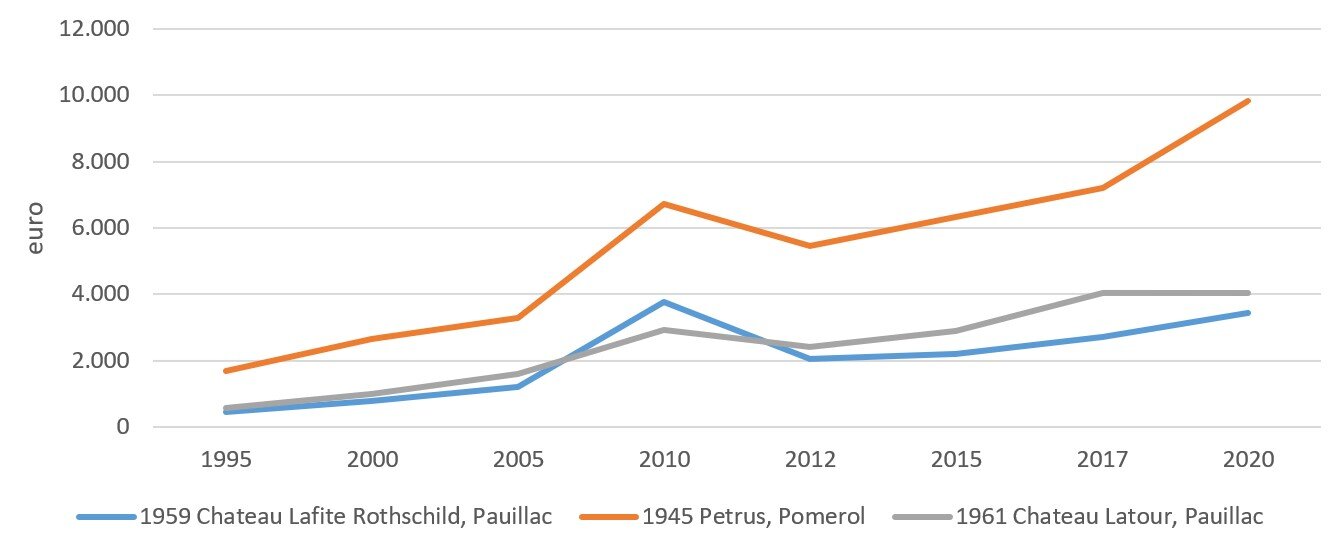

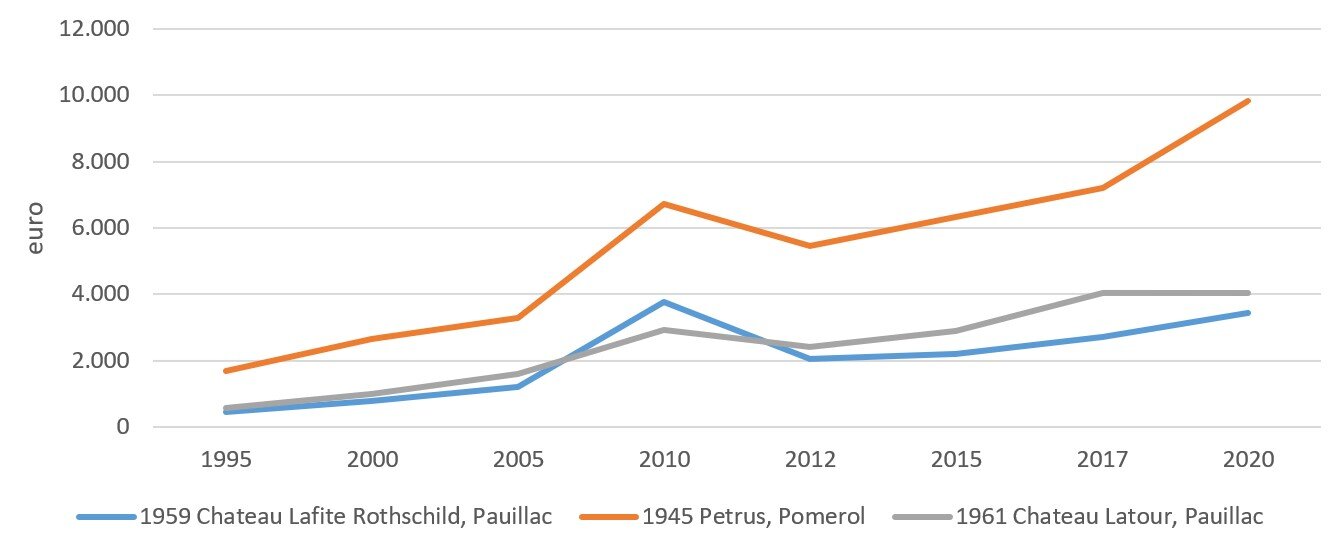

The second peer group includes three Bordeaux wines of elder vintages:

-

1959 Chateau Lafite Rothschild, Pauillac

-

1945 Petrus, Pomerol

-

1961 Le Pin, Pomerol

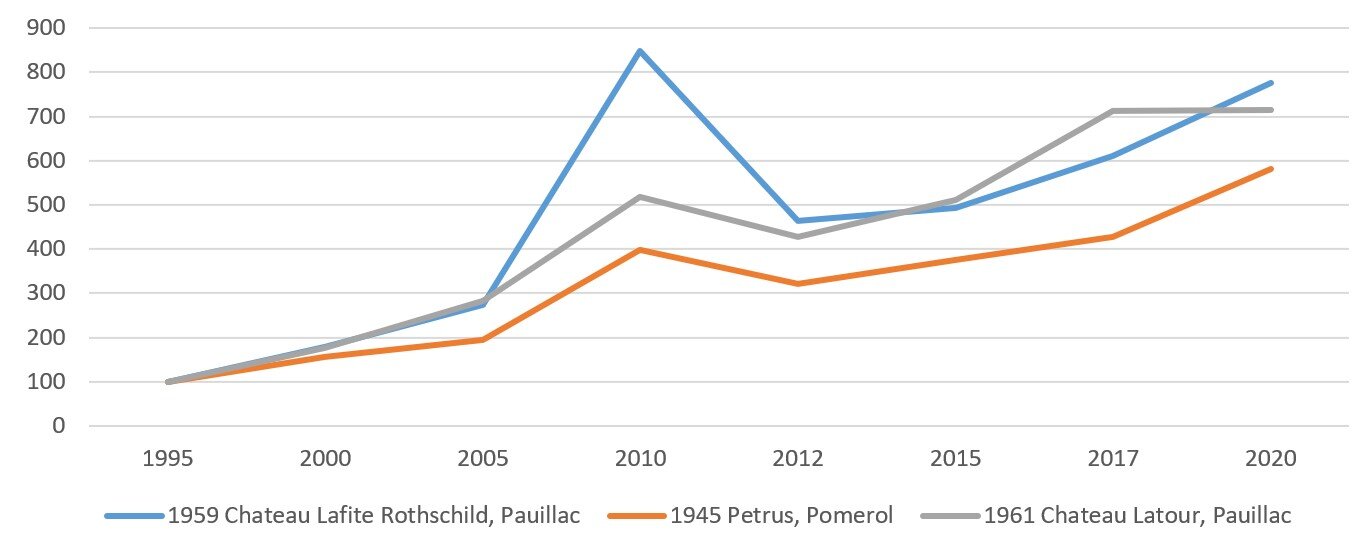

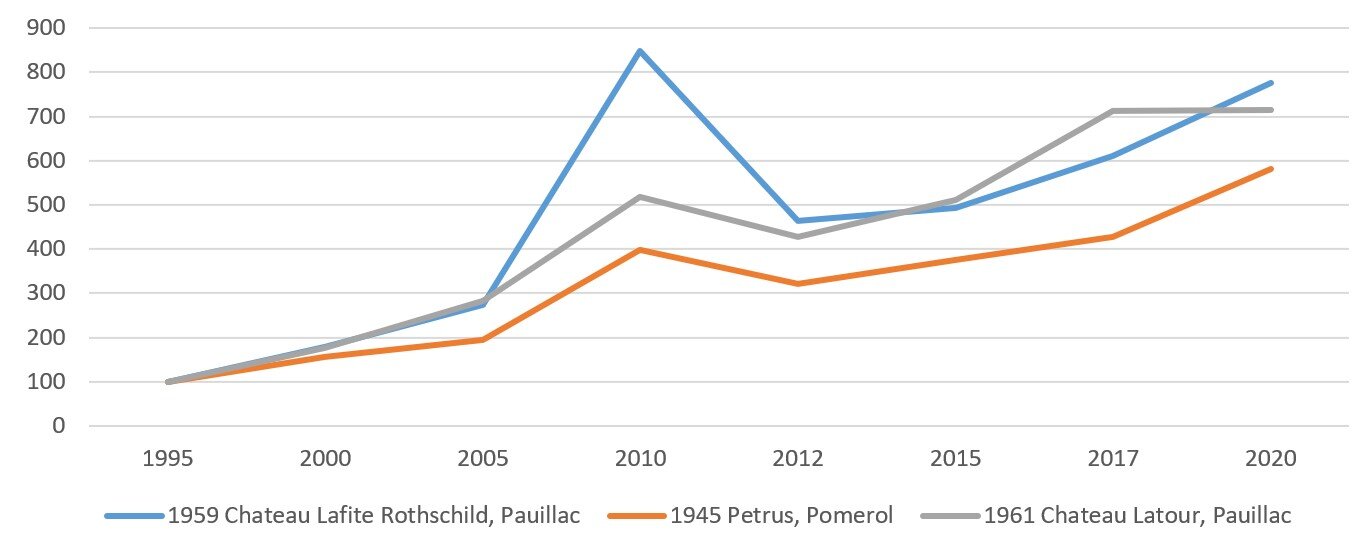

Exhibit #3

Price of Bordeaux wines peer group, mixed vintages

Exhibit #4

Price dynamics of Bordeaux wines peer group, mixed vintages

These vintages have shown more consistent returns. The prices have increased between 6-8 times over the last 25 years.

Over the long term, the demand-supply imbalance is exacerbated by increasing consumption and decreasing availability, and therefore fine wines become only more desirable due to their rarity.

Looking forward?

Whilst Bordeaux is always a good place to look for when searching investment-grade wines, Alti Wine Exchange has launched two outstanding vintages in the past months: Chateau Coutet Cuvée Émeri 2016 and Chateau Mouton Rothschild “Aile d’Argent” 2014 white.

#block-yui_3_17_2_1_1589187996641_26697 .sqs-gallery-block-grid .sqs-gallery-design-grid { margin-right: -20px; }

#block-yui_3_17_2_1_1589187996641_26697 .sqs-gallery-block-grid .sqs-gallery-design-grid-slide .margin-wrapper { margin-right: 20px; margin-bottom: 20px; }

Both wines still have bottles available for bidding on the platform’s marketplace.

Alti Wine Exchange also offers a perfect selection of fine wines that have all qualities to show outstanding returns in the future.

Read Sergey Glekov’s analyses on fine wine investment.

Fine and rare wines have enjoyed robust performance and low volatility in comparison to markets during Covid, gaining further room in diversified portfolios

Given the reputation of fine wine as an investment asset, we track price performance and potential returns. Meet the Alti Wine Exchange Internal Index.

In a period marked by covid-19, fine vintages from Portugal, Argentina and the US featured on the Alti Wine Indexes enjoy double-digit figures

From century-old fortified wines to Douro, the last wine frontier in Western Europe offers much still to be explored

From Pomerol to Pauillac, prolific fine wines make the French region a staple for investors

With fantastic climate and winemaking traditions, Tuscan wines offer great age-worthy bottles for investment

This grape produces outstanding and age-worthy full-bodied red wines. The best Chilean Syrah is listed on our platform