Photo: Martyna Jovaišaitė Paukštė, for Alti Wine Exchange

Dear reader,

It seems hard to think of building wealth in times of upsurge in covid-19. But yes, you can do it with fine wine investment. And you can start today.

All it takes is a simple change of strategy for the long term: commit yourself to a small share of alternative investments. In the case I will show you, relying mostly on fine and rare wines.

Yes, you really can build wealth if you invest in fine wine.

I’m Breno, proud fine wine investor and head of content at Alti Wine Exchange. And here is why and how you should go ahead a modified wealth-building approach by investing in wine. Thus, diversifying your portfolio with a profitable and ever more attractive asset for new prospective investors.

What makes fine wine a good alternative investment asset

In times of economic uncertainty, many investors go for physical and tangible assets: some buy real estate, gold, or art. These are famously referred scarce resources when we talk investment – real, hard assets.

Fine, rare wines like the ones offered by Alti Wine Exchange and traded on its marketplace are among them. They have unique advantages:

-

Without even having to get off the couch, you can digitally invest in them to be kept with full safety and perfect storing conditions in bond.

-

Unlike cryptocurrencies, for example, fine wines you purchase at Alti Wine Exchange are asset-backed (one token, one bottle).

-

You can physically enjoy your investment (you can ask for delivery at any time you want).

-

Wine has perpetual demand (as a consumer product), and every fine wine sold at Alti Wine Exchange improves with age.

-

Fine wine investment is based on supply and demand: as time goes by, bottles of a determined vintage are consumed, thus supply becomes rarer and makes the remaining ones appreciate due to stable or rising demand.

-

Even if wine price indexes may experience ups and downs, fine wines are hard assets that are not correlated to the stock market, thus subject to constant appreciation once you already hold them.

-

You can put bids and offers whenever you want in a secondary marketplace, maintaining full control.

-

You also have tax advantages, because considered a waste asset (but always check with your tax advisor in case you redeem a bottle!)

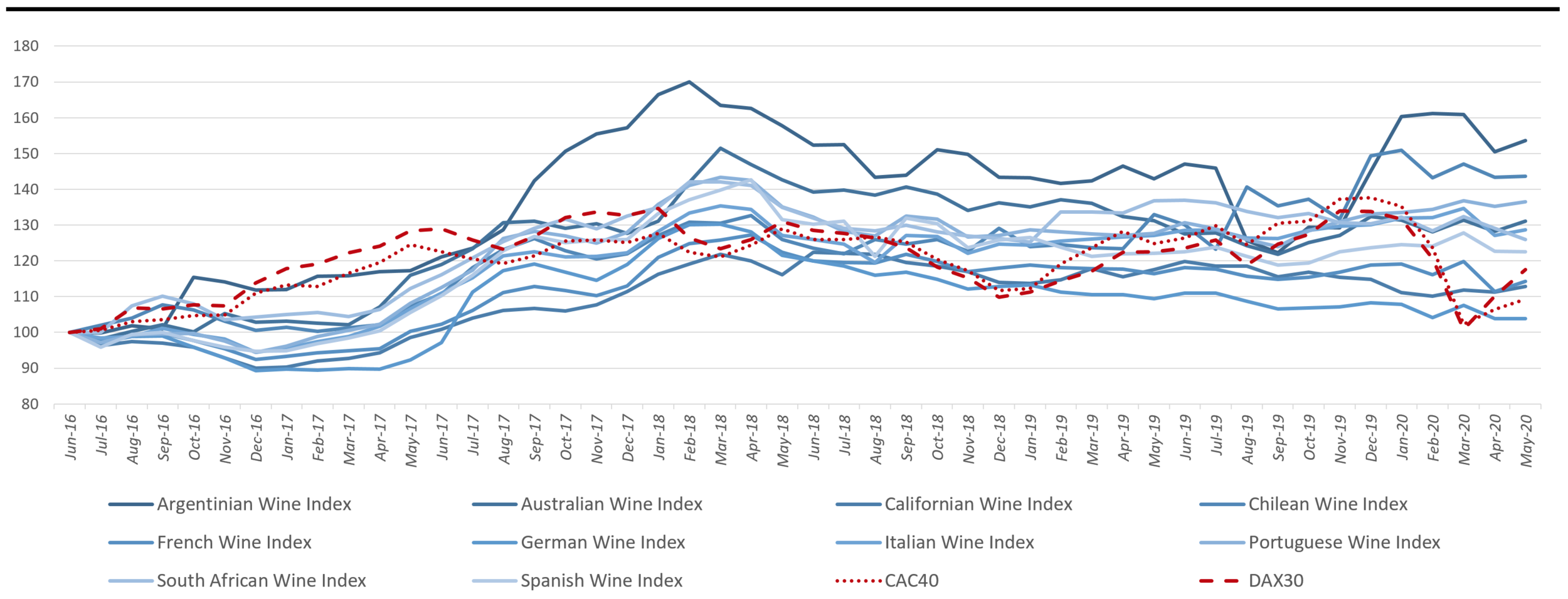

Don’t believe how this translates into appreciation? Compare the performance of our fine wine indexes versus key European stock indexes.

A new strategy to build wealth with the help of fine wines

As we go through this era of risks, it’s time to consider the strategic opportunity that a tangible asset such as fine and rare wine represents.

Here’s how you can adopt a simple strategy:

-

Commit around 3 to 5% of your portfolio to alternative assets as fine and rare wine.

-

Research the wines you would want to hold, ensuring they will withstand the test of time or improve as the years go by (the wines offered at Alti Wine Exchange are all previously proven to be age-worthy).

-

Find a reliable source, with certified provenance, to build your “wine collection” portfolio to avoid cold calls and scams.

-

Unless you plan on redeeming your bottles, keep them in bond for years to ensure the best storing conditions. Consequently, ensuring the maximum possible appreciation they can have as tangible assets.

-

When you are all set and good to go, you can start to invest even monthly, as you would do with the spare of your salary.

-

Buy diversified wines (country, vintage, style…).

Here are a few top tips on what you really need to know to start investing in fine wine.

Why investing in fine wine is easier and safer with Alti Wine Exchange?

With our innovative blockchain-based platform, you can do it all I showed you above with little concerns, full transparency and safety.

We are the world’s first blockchain-based platform for wine exchange. We work every day to make wine trading simple and convenient for everyone by offering direct access to rare wines and — at the same time taking care of storage and security of their assets in the Bordeaux City Bond.

We are happy to say that we have a whole team of superstar investment-grade wines available for investment now.

In times when stocks may heavily drop or float, what we offer is an opportunity to add fine, rare vintages to your portfolio as great alternative assets. You don’t even have to be an expert.

Most importantly? We are free to join and easy to start trading. Got doubts? Check our FAQ.