In a period marked by the covid-19 lockdowns, fine vintages from Portugal, Argentina and the United States featured on the Alti Wine Indexes enjoyed double-digit growth.

Sergey Glekov

Senior financial advisor

The unprecedented lockdowns and sudden economic stops being implemented by countries worldwide in order to “flatten the curve” of the covid-19 pandemic have created a unique combination of factors: supply shocks, demand shocks, and stunning monetary and fiscal measures.

For most financial and equity markets around the world, the first quarter of 2020 was one of the worst in history.

The coronavirus affects fine and rare wine markets as well, as we have recently seen.

Most of the indexes constituting the family of Alti Wine Indexes have shown a relatively weak performance in first 5 months of 2020. The family of Alti Wine Indexes covers fine and rare wines from Europe, the Americas, Africa and Australia and includes 180 wines separated into 10 wine indexes.

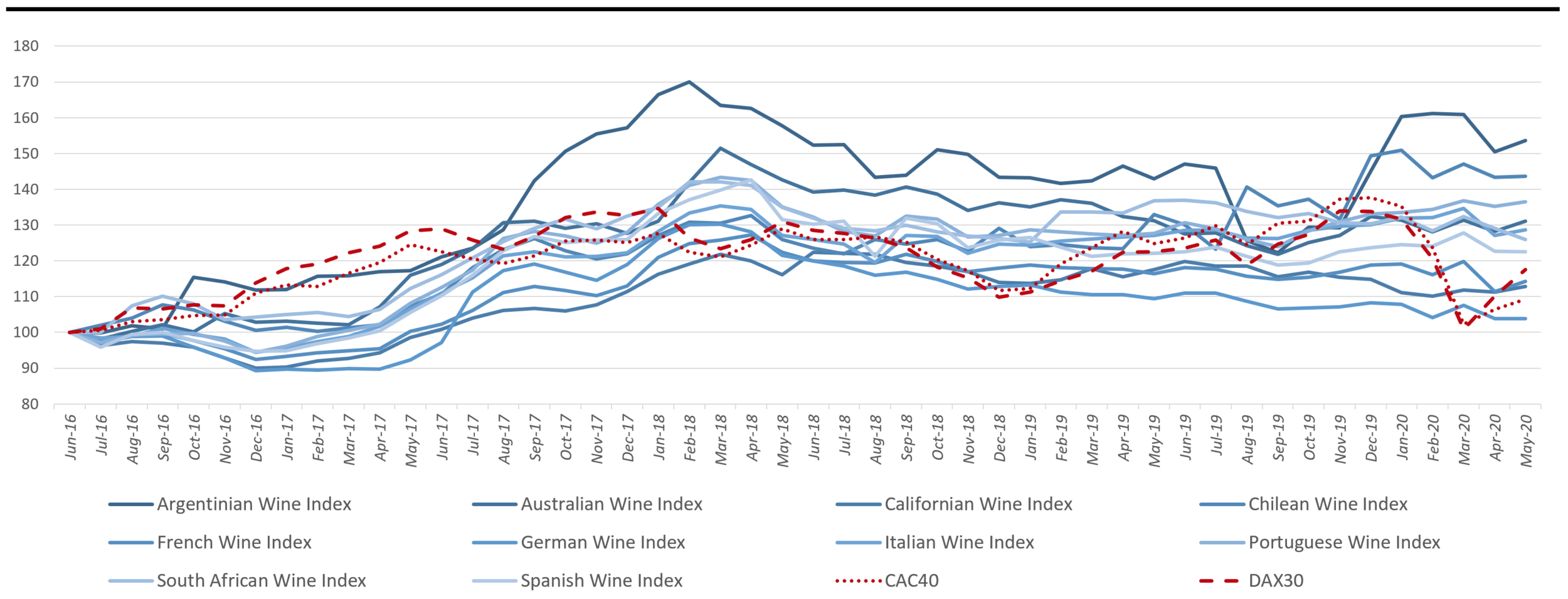

Exhibit #1

Alti Wine Indexes vs Key European Stock Indexes

(Click on the image to enhance it)

However, a level of volatility in the fine wine market was substantially lower and no wine indexes experienced a plunge similar to stock market indexes like CAC40 or DAX30 in March.

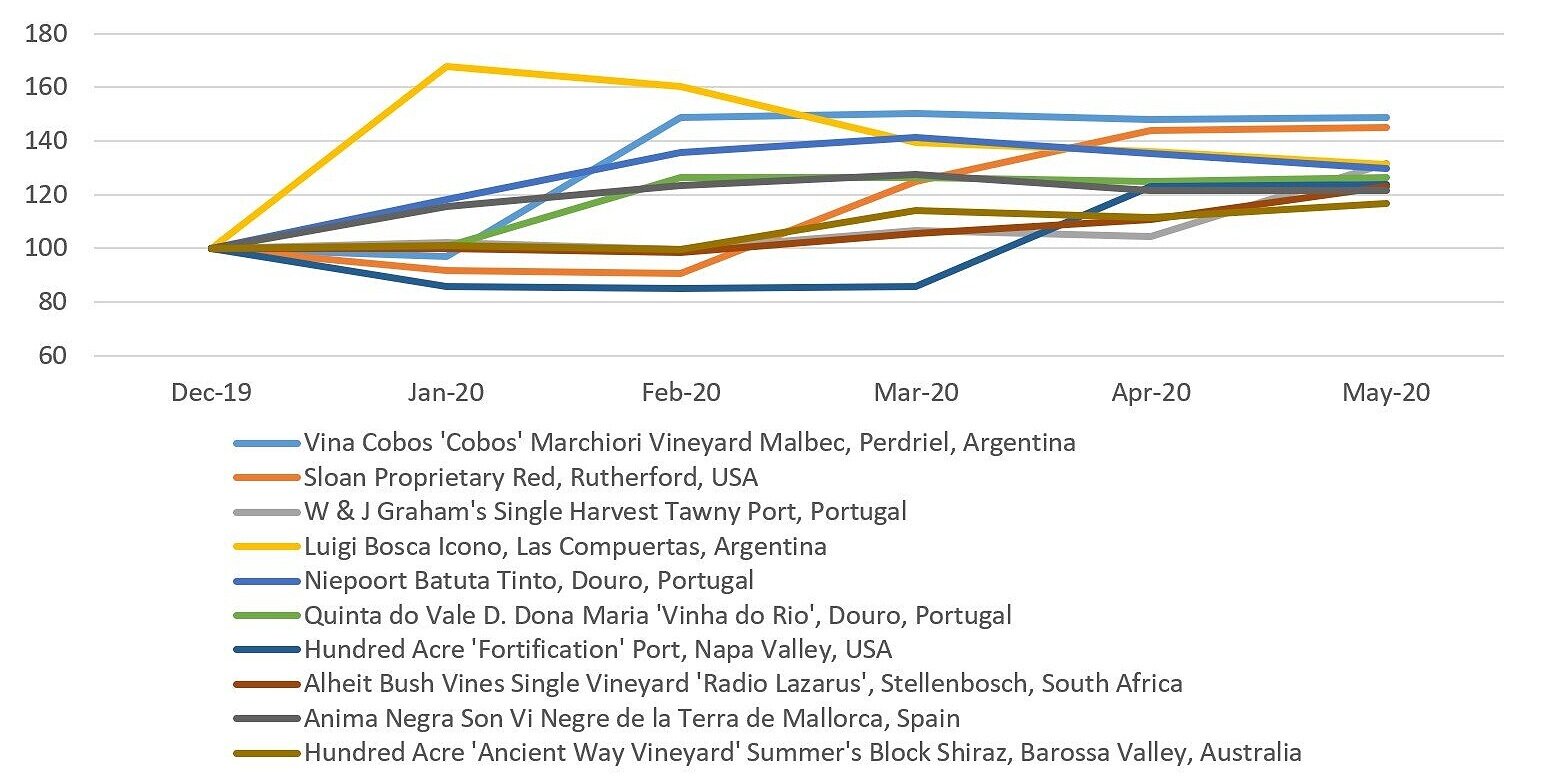

Meanwhile, prices of several wines from Alti Wine Indexes have shown even double-digit growth rates in the first 5 months of 2020.

The top 10 wines by price growth in January-May 2020 are presented in the table below.

Exhibit #2

Price growth in 2020 (Jan-May, 2020)

Exhibit #3

Top 10 performing wines from Alti Wine Indexes Family (Jan-May)

Portuguese wines became absolute leaders in the rating, with 3 of them in this Top 10. However, overall, the New World wines outperformed the Old World’s (6 vs 4).

Exhibit #4

Top 10 best performing wines by country

Three Portuguese wines are already listed on Alti Wine Exchange, all from the best performing categories seen here – Portuguese red blend wines and old fortified wines.

-

2014 Quinta do Vallado Adelaide Douro

-

1888 Quinta do Vallado ‘ABF’ Very Old Port

-

1918 Moscatel Roxo de Setúbal Superior

I wrote more about investing in Portuguese wines a while ago. Read it here.

We believe that fine and rare wine offers a unique balance of risk and return, which become even more important in periods of extreme market stress and volatility as this one.

Fine wines as investment assets have low volatility, they are physical assets and can be considered as defensive asset class.

Combining reasons mentioned above with unique features of Alti Wine Exchange: bottles are authentic with confirmed provenance and stored in the best conditions in Bordeaux City Bond, Alti Wine Exchange provides brilliant opportunity for investors to diversify their portfolio by adding fine and rare wines. This is especially important in the current turbulent financial market conditions.

You can find the latest updated indexes right here.

More wine investment articles by Sergey Glekov